shopVOX Pro

Getting started with shopVOX Pro

What is shopVOX? - shopVOX Pro

Getting started with shopVOX - shopVOX Pro

Your Account - shopVOX Pro

Icons and Interface Tour - shopVOX Pro

Inviting Users to Your Team - shopVOX Pro

Setting Roles for your Team - shopVOX Pro

My Profile + SMTP Settings - shopVOX Pro

Import Customers & Contacts from your Accounting software - shopVOX Pro

Adding Vendors - shopVOX Pro

How do I Update Our Billing Info? - shopVOX Pro

Setup Vendor Catalogs - shopVOX Pro

A Guide to Creating Your First Order - shopVOX Pro

Microsoft Outlook - Two Factor Authentication - shopVOX Pro

Customize your account with Add-on Features - shopVOX Pro

Importing and Exporting Customers & Contacts with a spreadsheet - shopVOX Pro

Transactions: New Quote + Quote Approval Process - shopVOX Pro

Database Migration Support for shopVOX - Legacy data - shopVOX Pro

Notifications: Keep your entire team up to date - shopVOX Pro

Color Picker - Saving Colors - shopVOX Pro

Transactions: What are Transactions? - shopVOX Pro

Transactions: New Sales Order - shopVOX Pro

"What's New" Feature: Your Guide to shopVOX Updates - shopVOX Pro

How Do I Cancel My shopVOX Account? - shopVOX Pro

Transactions: New Invoice - shopVOX Pro

How to Create a Quote - shopVOX Pro

shopVOX's History Tracking for Quotes, Sales Orders, Invoices, and Jobs - shopVOX Pro

Save Time with Emailed Document Templates - shopVOX Pro

Webinars in shopVOX Pro: Learn and Grow with Us - shopVOX Pro

shopVOX Express vs. Pro. Explaining the differences in Workflow - shopVOX Pro

Optimizing Quotation Efficiency: Unlocking the Power of Multiple Quantities with shopVOX - shopVOX Pro

Workflows - Quick Overview Express VS Pro - shopVOX Pro

Global Search in shopVOX - shopVOX Pro

Step Board: A Smarter Way to Track Jobs in Your Workflow - shopVOX Pro

Machine Scheduler - shopVOX Pro

Enhancing Security with Multi-Factor Authentication in shopVOX - shopVOX Pro

Installation Job Board - shopVOX Pro

Setting Up SMS using Twilio - shopVOX Pro

Sales - shopVOX Pro

Managing Customer and Leads

Workflow Stages and Templates Explained - shopVOX Pro

Using a TV for your Job Board - shopVOX Pro

Connecting shopVOX to QuickBooks Desktop: Streamlined Sync for Your Financials - shopVOX Pro

How to Price Color Changes - shopVOX Pro

Customer Alerts & Flags

Sales Commissions - shopVOX Pro

Creating Your Own Custom Job Views - shopVOX Pro

Updating a Workflow in shopVOX: A Complete Guide - shopVOX Pro

Streamline In-Store Payments with with Stripe Terminal or USB Credit Card readers - shopVOX Pro

Avalara AvaTax - Sales tax setup guide - shopVOX Pro

Merge Customers - shopVOX Pro

Adding new Contacts to Existing Customers - shopVOX Pro

Tracking Partially Fulfilled Apparel Orders in shopVOX

Customer Contacts: Setting Primary and Billing Contacts - shopVOX Pro

How to Price Color Matches - shopVOX Pro

Sales Leads on Business Intelligence Dashboard - shopVOX Pro

How to create Partial Invoices - shopVOX Pro

Multiple Currency Add-On - How it works and setting up - shopVOX Pro

Sales Leads - Sample Pipeline Setup - shopVOX Pro

Sales Order States - shopVOX Pro

Reports - shopVOX Pro

Understanding Quote Statuses in shopVOX - shopVOX Pro

Managing dates on Quotes, Sales Orders, and Invoices - shopVOX Pro

Products & Pricing - shopVOX Pro

Advanced Pricing concepts

Understanding Modifiers in shopVOX: Enhancing Product Pricing Flexibility - shopVOX Pro

Increasing Product Prices by a Percentage in shopVOX - PBase - shopVOX Pro

A Comprehensive Guide to Ternary Operations - shopVOX Pro

Using the Reference Field for Material Selection and Labor Charges - shopVOX Pro

Understanding Pricing Levels - shopVOX Pro

Mastering the Use of *, /, +, -, >, <, >=, <=, % in Ternary Operations - shopVOX Pro

How to Update Pricing in shopVOX: A Comprehensive Guide to Machine Rates, Labor Rates, and Materials - shopVOX Pro

Unlocking Efficiency: Harnessing System Variables and References to Create a Click Charge - shopVOX Pro

Undertanding Sell/Buy Ratio - shopVOX Pro

Product System Formula - with Filter - shopVOX Pro

Product Templates - Custom Formula Logic - shopVOX Pro

Product Template - Add New Defualt Items Configuration Window - shopVOX Pro

Workflow: Machine Time Formula

Custom Logic in shopVOX: Evaluating Multiple Boolean Modifiers - shopVOX Pro

Mastering the Use of &&, ||, and === in Ternary Operations - shopVOX Pro

Products: Utilizing the "Reference" Field to Combine two References into one Click Charge - shopVOX Pro

Golden Products

Golden Product: Flyer - with BOM - shopVOX Pro

Golden Product: Postcard- with BOM - shopVOX Pro

Golden Product: Greeting Cards - with BOM - shopVOX Pro

Golden Product: Calendar - with BOM - shopVOX Pro

Golden Products List by Global Region - shopVOX Pro

Products shopVOX Golden Products - shopVOX Pro

Golden Product: Brochures - with BOM - shopVOX Pro

Golden Product: Print + Copy - with BOM - shopVOX Pro

Golden Product: Business Cards - with BOM - shopVOX Pro

Golden Product: Booklet - with BOM - shopVOX Pro

Golden Product: Door Hangers - with BOM - shopVOX Pro

Adding Your Own Products - shopVOX Pro

How to Publish Products - shopVOX Pro

Product Templates & Formulas Explained - shopVOX Pro

Product Templates - Using System Formulas - shopVOX Pro

Product Templates - Using System Formulas - Adding a Double Sided check box - shopVOX Pro

Product Templates - User Created Formulas - shopVOX Pro

Product Templates - User Created Formulas - Adding a Double side check box - shopVOX Pro

Product Pricing - Round to 2 or 4 Decimal places - shopVOX Pro

Products: Grid Pricing Example - shopVOX Pro

Managing Your Product Catalog - shopVOX Pro

Setting Up Labor Rates in shopVOX: A Simple Guide - shopVOX Pro

Setting Up Machine Rates in shopVOX: A Comprehensive Guide - shopVOX Pro

Materials Management in shopVOX: A Comprehensive Guide - shopVOX Pro

Product Pricing: Material Wastage Calculator - shopVOX Pro

Product Features - Custom Fields - shopVOX Pro

Products - Pricing Type - Formulas - shopVOX Pro

Product Pricing : Cost Plus - shopVOX Pro

Uploading and Sending Proofs for Approval - shopVOX Pro

Product Templates - How to Turn on a Product Template - shopVOX Pro

Guide to Using the Panels UI - shopVOX Pro

How to Price Promotional Products - shopVOX Pro

How to Price Digitizing - shopVOX Pro

How to Price Direct To Garment Printing - shopVOX Pro

Product Template - Add New Drop-Down Menu Configuration Window - shopVOX Pro

Comprehensive Guide to Setting Up a Basic Apparel Product - shopVOX Pro

Pricing Methods: Standard, Product, and Cost Plus Pricing - shopVOX Pro

Custom Product, Template, and Code Modifiers - shopVOX Pro

Accounting and Reporting - shopVOX Pro

QuickBooks Desktop

Connecting Your Sage One Accounting - shopVOX Pro

Transaction Numbers Settings - shopVOX Pro

Add your Payment Gateway - shopVOX Pro

Connecting to your Accounting Software - shopVOX Pro

Connecting your XERO account - shopVOX Pro

Connecting Your QuickBooks Online Account - shopVOX Pro

Common Xero Sync Error messages explained - shopVOX Pro

Connecting External Gateways

Add your Payment Gateway - shopVOX Pro

shopVOX Pay: Integrated Payment Processor

Integrated SAGE Promo ( promotional catalog ) - shopVOX Pro

Setting Up Your Account - shopVOX Pro

Accounting

Common QB Questions - shopVOX Pro

Charging a Program Fee - shopVOX Pro

Differences between USA QuickBooks Online and Non-USA QuickBooks Online - shopVOX Pro

shopVOX Setup of Tax Codes for Quickbooks Canada Desktop/Online - shopVOX Pro

How are Users Billed?

Five challenges to consider when setting up your Account - shopVOX Pro

How to Filter MFA Email Alerts in Outlook and Gmail - shopVOX Pro

shopVOX Work Flow - The Big Picture - shopVOX Pro

Leveraging External IP Addresses for Security - shopVOX Pro

Hide or Show Quotes & Sales Orders, Ordered Quotes, and Invoiced Quotes and Sales Orders - shopVOX Pro

Add Your Logo and Company Info - shopVOX Pro

How to add Additional Charges to your Quotes, Sales Orders and Invoices - shopVOX Pro

Terms and Conditions - shopVOX Pro

Document's and PDF Settings - shopVOX Pro

Group and Describe Jobs with Tags - shopVOX Pro

How to Change Password - shopVOX Pro

Forms: Customizing Forms - shopVOX Pro

Common Questions About Users - shopVOX Pro

Flagging a user as a "Sales Rep" - shopVOX Pro

Industry Specific Content - shopVOX Pro

Automation & Integrations - shopVOX Pro

Shipping

ShipStation integration - shopVOX Pro

Shipping Profiles - setting up Products to automate number of boxes - shopVOX Pro

APIs

What is an API? - shopVOX Pro

How an API Works: A Simple Explanation - shopVOX Pro

Leveraging the Power of shopVOX with API Integration - shopVOX Pro

API Essentials: Understanding the Backbone of Software Communication - shopVOX Pro

Building Your Own Custom Integration with shopVOX APIs - shopVOX Pro

JSON Demystified: The Universal Language of Data Exchange - shopVOX Pro

I'm having an issue with the shopVOX APIs. Who do I contact? - shopVOX Pro

Does shopVOX do custom development? - shopVOX Pro

Does shopVOX integrate with Salesforce? - shopVOX Pro

Setting up Mailchimp Integration - shopVOX Pro

Sales Leads Web Form in shopVOX: Streamline Prospect Capture and Management - shopVOX Pro

Simplify User Authentication with OAuth Integration in shopVOX

Who to Contact for shopVOX API Issues - shopVOX Pro

Setting up Constant Contact Integration in shopVOX

Does shopVOX integrate with Microsoft Project? - shopVOX Pro

API and Webhooks integration feature - shopVOX Pro

shopVOX Go! App - shopVOX Pro

Discovering Your shopVOX API Credentials: A Step-by-Step Guide - shopVOX Pro

Automation - Scheduled Actions - shopVOX Pro

What are some popular advantages when using Zapier? - shopVOX Pro

FAQs - shopVOX Pro

shopVOX specific terms

Common questions

How to increase Database size ? - shopVOX Pro

Opening PDFs directly in your browser - shopVOX Pro

shopVOX User Types - shopVOX Pro

Empowering Project Managers in the Proofing Process: A Guide to Workflow Enhancement - shopVOX Pro

Hex Color file to match PMS color chart - shopVOX Pro

How do I disabled user? - shopVOX Pro

What is the Admin checkbox for when creating a new user? - shopVOX Pro

Invoicing - Enhancing Customer Engagement: Tracking Invoice Views with shopVOX Pro

Where do jobs "fit" in the order process in ShopVOX? - shopVOX Pro

Why can't I print the PDF documents directly, instead of downloading? - shopVOX Pro

How can I send a quote and a proof together in one email to my customer? - shopVOX Pro

Terms and Definitions

Printing Examples - Letterpress Printing

Printing Types Defined

Printing Examples - Digital Printing

Printing Examples - Offset

Errors and Troubleshooting

How to clear history from Chrome browser?

When I convert a quote to a work order, does the name of the order and the line item description carry forward or do I have to rewrite?

How to optimize your browser for shopVOX - shopVOX Pro

Streamlining Proof Attachment to New Sales Orders for Enhanced Efficiency - shopVOX Pro

Setting Up Minimum Order Amounts in shopVOX - shopVOX Pro

What is our IP address for the mail server ? - shopVOX Pro

Custom PDF in shopVOX - shopVOX Pro

Onboarding - shopVOX Pro

Onboarding - Simple Products Setup

Mastering Product Setup in shopVOX: A Step-by-Step Guide from Basics to Advanced Customization - shopVOX Pro

Lesson 1: Setting Up a Basic Product - shopVOX Pro

Lesson 2: Introducing Dynamic Pricing Based on Square Footage - shopVOX Pro

Lesson 3: Enhancing the Product with Templates and Dropdown Menus - shopVOX Pro

Lesson 4: Adding a Default Item Linked to Modifiers - shopVOX Pro

Lesson 5: Implementing a Double-Sided Boolean Modifier with Conditional Logic - shopVOX Pro

Lesson 6: Replacing a System Formula with a Custom Formula - shopVOX Pro

Lesson 7: Integrating Custom Formula into the Conditional Double-Sided Logic - shopVOX Pro

Lesson 8: Adding an Additional Dropdown Menu - shopVOX Pro

Lesson 9: Creating Custom Fields to Enhance Usability - shopVOX Pro

Lesson 10: Implementing a Rush Charge Option - shopVOX Pro

Summary Conclusion: Lessons 1-10 - shopVOX Pro

Quoting and Order Management - shopVOX Pro

Adding/Updating Customers and Contacts - shopVOX Pro

Purchase Orders - How to Add Materials and Products to a Purchase Order in shopVOX PRO for the Inventory Add-on - shopVOX Pro

Stay Organized with Notes, Tasks, and Assets - shopVOX Pro

Roll-Up Line Items to Combine Pricing - shopVOX Pro

Purchasing and Receiving Blank Garments - shopVOX Pro

Creating Your Own Custom Views - shopVOX Pro

How to Issue Refunds and Credit Memos - shopVOX Pro

Add Ons - shopVOX Pro

Ecommerce

Ecommerce - Web Store - shopVOX Pro

Ecommerce: Creating Discount Codes - shopVOX Pro

Ecommerce - Steps to setup custom URL for paid cPortal - shopVOX Pro

Webstore & Shopping Cart Examples from shopVOX Users - shopVOX Pro

Setting up a Shopping Cart to sell online - Changing the URL - shopVOX Pro

Ecommerce - cPortal - White Label Setup - shopVOX Pro

Ecommerce - cPortal - shopVOX Pro

Ecommerce - Overview - shopVOX Pro

Empowering Your Customers with the Free cPortal - shopVOX Pro

Ecommerce - Shopping Cart - shopVOX Pro

Ecommerce - Apparel Web Store - shopVOX Pro

Inventory

Inventory Module Add-On - Setup and use of Feature - shopVOX Pro

Inventory Module Add-On - Setup Locations - shopVOX Pro

Questions to Consider About the Inventory Module in shopVOX - shopVOX Pro

Inventory Module Add-On - shopVOX Pro

Divisions

Vehicle Wrap

Amazon S3 Storage

Amazon S3 (Simple Storage Service) - Add-On - shopVOX Pro

Amazon S3 Add-On (Simple Storage Service) - Amazon S3 Pricing - shopVOX Pro

Amazon S3 Add-On (Simple Storage Service) - What is it? - shopVOX Pro

Projects in shopVOX: Comprehensive Guide - shopVOX Pro

Service Job Add-On: Streamline Your Workflow with shopVOX's New Service Job Feature - shopVOX Pro

Whats New

2025 Whats New

Thu, 02/27/2025 Update: Down payment can now be a dollar amount. Pro & Express

19/9/25 Update: New Webstore Features

Fri, 01/24/2025 New Notification event: Job step Completed Pro

Wed, 01/29/2025 Highlight: Panel Pricing UI Pro

Sun, 01/19/2025 Freight charges on Purchase Orders Pro

2024 Whats New

Mon, 10/07/2024 Enhancement in Task Pro & Express

Thu, 05/16/2024 Quick Tip: Ability to copy Material/Product Names in Purchase Order Line Items Pro

Tue, 10/08/2024 New feature added: Task templates to prefill repeated Tasks Pro & Express

Tue, 09/24/2024 New update! Connect to your ShipStation account! Pro

Wed, 08/07/2024 Enhancing Dropdown Menus for Material Search Pro

Mon, 04/29/2024 Added a new link directly on the Home screen to navigate Reports

Mon, 07/29/2024 Ability to enter Ft and Inches vs just Inches. Pro

Wed, 06/05/2024 Added a new addition to the Products called 'Published'. Pro & Express

Mon, 04/22/2024 Option to conceal Costs and Markup for apparel items when adding line items

Sun, 10/27/2024 Role-Based Permissions for Editing or Overriding Line Item Costs(Unit Cost) Pro

Wed, 11/27/2024 Apparel images on customer PDF? Show or Don't show! Pro

Fri, 10/04/2024 New Apparel catalog available for US/CAN accounts! Pro & Express

Tue, 05/21/2024 Added New Email Template Tag: {{txn_downpayment}} Pro & Express

Wed, 05/01/2024 Daily Tip - Add shopVOX email id's as contacts!

Tue, 11/26/2024 Track Partially Fulfilled Apparel items on a Sales Order. Pro

Thu, 11/14/2024 We added a new valuable Update in Pricing templates! Pro

Wed, 05/15/2024 Enhanced Notification System: In-app Alert for Proof Uploaded Pro & Express

Wed, 07/24/2024 S3 Storage for your assets. Pro

Tue, 07/02/2024 Implemented the "Board Feet" Formula within the shopVOX Product System. Pro

Sat, 08/10/2024 Australia/New Zealand regional Golden Products have been updated! Pro & Express

Mon, 04/15/2024 Ability to import payments from Xero to shopVOX

Wed, 06/05/2024 Tasks, notes, and assets associated with a quote to sales order to invoice will now be displayed in the Related Assets section. Pro & Express

Thu, 05/09/2024 Dynamic Customer Identification in PDFs

Fri, 05/17/2024 Job Board Overview and Best Practices Pro & Express

Tue, 11/05/2024 2FA - Two Factor Authentication is now active (Optional) Pro & Express

Tue, 10/29/2024 Enhancement to the online proofing feature. Pro & Express

Fri, 07/19/2024 Included in the reporting are two new reports: 1. Quotes with Line Items, and 2. Sales Orders with Line Items. Pro

Thu, 08/08/2024 Microsoft Outlook - Two Factor Authentication Pro & Express

Wed, 05/15/2024 Avalara enabled Stores Changed the way of tax syncing to QBO

Fri, 01/24/2025 Highlighted feature: Quote Review and online approval Pro

Fri, 09/06/2024 Allow Line Item Taxable Override Pro & Express

Fri, 05/31/2024 Added another PDF for Invoice Statements: Aging Summary PDF. Pro & Express

Tue, 08/20/2024 Pro tip: Controlling and protecting access to your customer and transaction data! Pro

Mon, 10/28/2024 New Permission setting! Pro

Fri, 10/18/2024 eCommerce feature update: There have been recent Apparel Webstore improvements Pro

Wed, 10/16/2024 Announcement: Another new US Apparel catalog available! Pro & Express

Thu, 05/30/2024 “Mastering Customer Proof Reviews: Unveiling the Dollar Value Flag” Feel free to use or modify it as needed! 😊📝 Pro & Express

Wed, 11/06/2024 Colors: there is a new way to save colors! Pro & Express

Mon, 09/16/2024 Express & Pro webinar articles Pro & Express

Wed, 08/28/2024 Update: The Purchase Order State will automatically change from Draft to Ordered once the Vendor Order ID is eneterd on the PO. Pro & Express

Thu, 04/25/2024 Added Missing Email PDF types in SO level while sending emails

Thu, 05/02/2024 Quick Tip: Within each user profile, there's a setting to toggle between Full Screen Mode and Fixed Layout.

Fri, 11/08/2024 Download option for AI Template and PDF Template for Vehicle Wrap Products Pro

Tue, 07/02/2024 Introducing the "Total_Area" Formula in ShopVOX! Pro

Fri, 07/26/2024 Update: New option for measurements on a Product. Now you can enter Feet and Inches, instead of just Inches. Pro

Fri, 05/31/2024 Quick Tip: What does the yellow color indicate on a job board? Pro & Express

Mon, 02/10/2025 Ability to change the workflow on a job without deleting the job Pro

Mon, 04/22/2024 Added the JB# in all the Job related reports

Tue, 06/04/2024 Added Fulfilment Type Column on the Order Board. Pro

Thu, 04/25/2024 Ability to handle Spl charges like setup/shipping/Misc/finance charges through SO API

Fri, 02/28/2025 Payment Gateway link: Ability to turn the flag off by default when emailing customer Pro

Thu, 10/17/2024 Enhancements in Materials: Upload the Material Pictures on the Show Overview Only Screen. Pro

Mon, 09/09/2024 Restrict Users to add/change the Discounts on the Line Item of the Transactions Pro

Tue, 04/23/2024 Ability to add "external name" field on the labor rates.

Thu, 04/25/2024 Added functionality to restrict the users with IP addresses

Fri, 07/26/2024 Added Hide Ordered Client Orders flag under Transaction Settings. Pro

Tue, 10/22/2024 Send iCal Email for Service Jobs in Tasks section Pro

Wed, 08/28/2024 Enhancement in New Customer page Pro & Express

Mon, 05/13/2024 Disabled Adding custom line item to Non Admin Users

- All Categories

- shopVOX Pro

- Sales - shopVOX Pro

- Managing Customer and Leads

- Connecting shopVOX to QuickBooks Desktop: Streamlined Sync for Your Financials - shopVOX Pro

Connecting shopVOX to QuickBooks Desktop: Streamlined Sync for Your Financials - shopVOX Pro

Updated

by Tyler MacDonald

Updated

by Tyler MacDonald

In this guide, we’ll walk you through setting up the integration between shopVOX and QuickBooks Desktop, enabling smooth syncing of invoices, payments, credit memos, and purchase orders. Once connected, this integration will keep your sales, accounts receivable, and sales tax information seamlessly up-to-date, providing a comprehensive view of your financials across platforms.

Initial Setup Requirements

Before starting the sync process, there are a few preliminary steps to take care of:

- Install the QuickBooks Web Connector – Follow QuickBooks Desktop’s instructions to download and install the Web Connector.

- Import Key Financial Data from QuickBooks – Add your Chart of Accounts, Sales Taxes, Term Codes, and Payment Methods to your shopVOX account to ensure a smooth connection and data mapping.

Items Eligible for Syncing

The integration supports syncing the following items:

- Invoices

- Payments

- Credit Memos

- Purchase Orders

Recommended Syncing Order

To maintain data accuracy, follow this sequence when syncing:

- Invoices

- Credit Memos

- Payments

- Un-Applied Payments

Note: Purchase Orders can be synced at any time.

Setting Up the QuickBooks Web Connector

Step 1: Establish the connection in QuickBooks, go to File > Update Web Services and select the QuickBooks Web Connector to open the application.

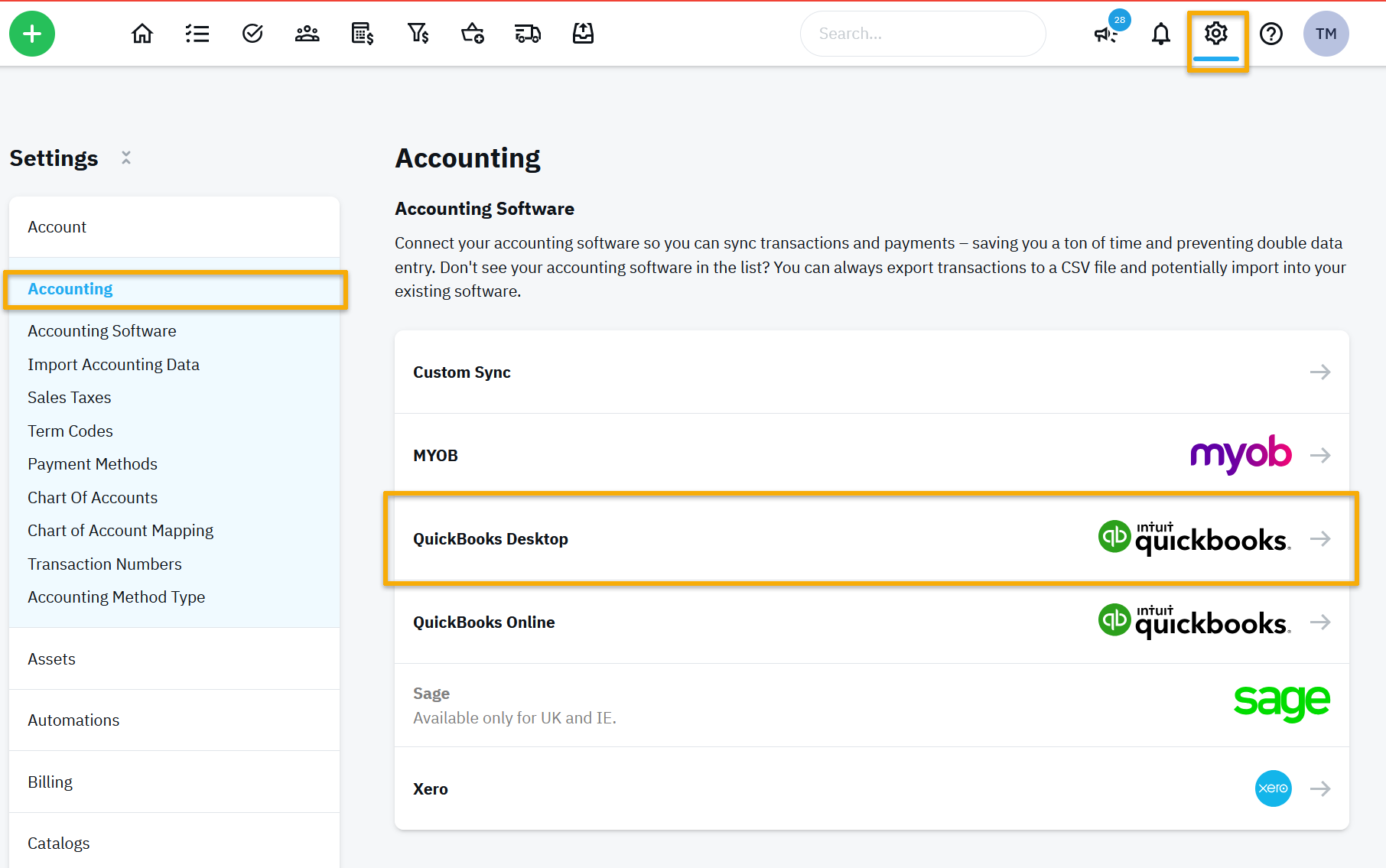

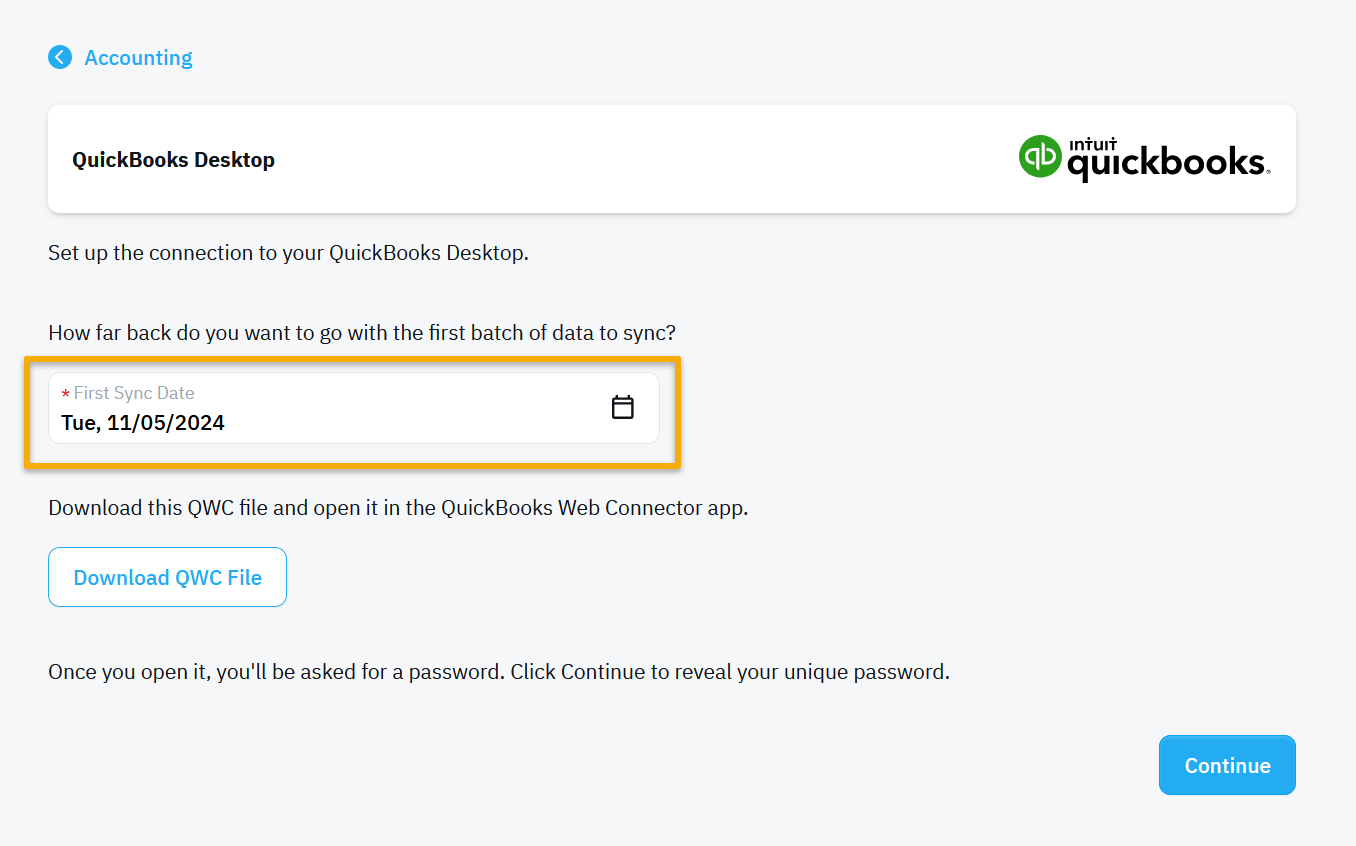

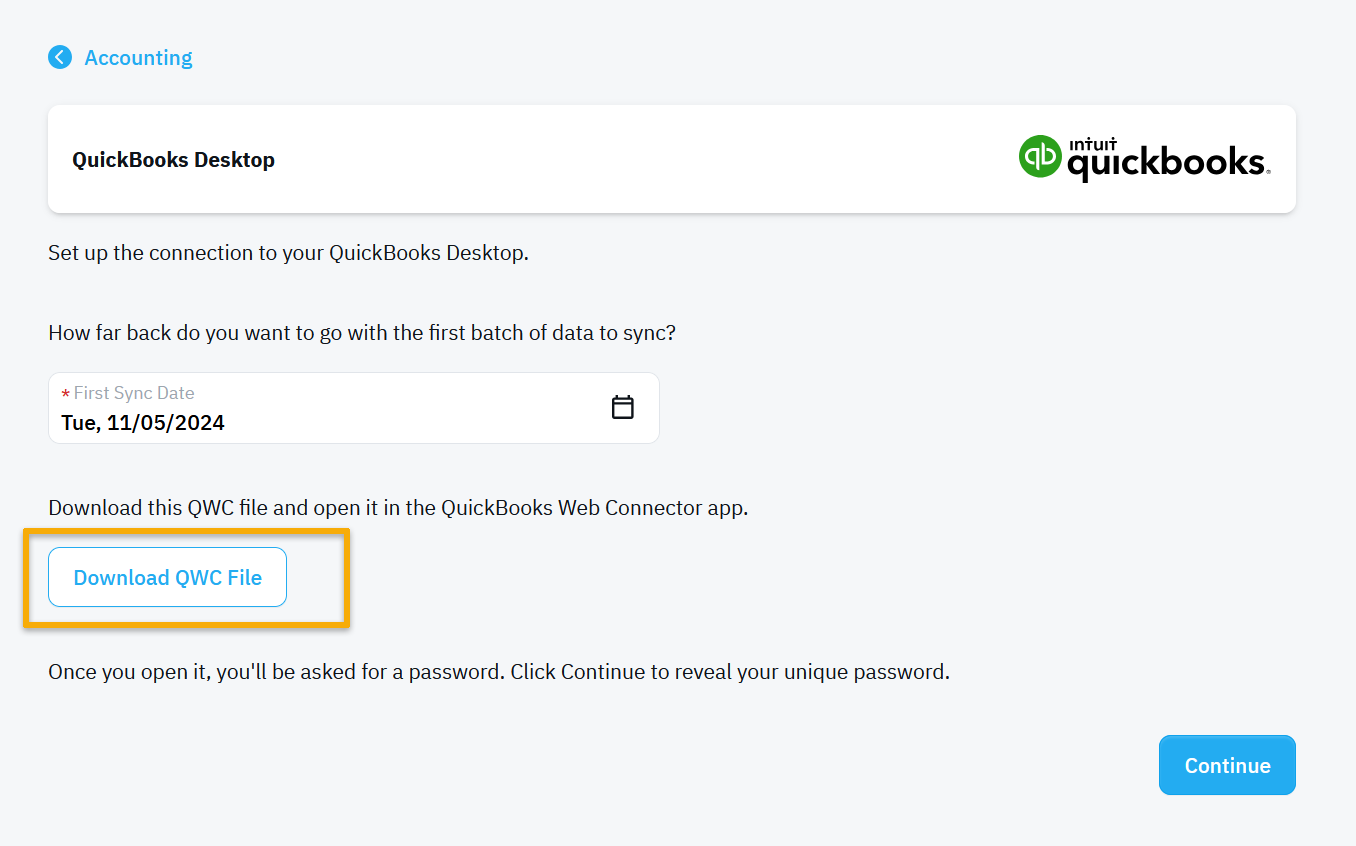

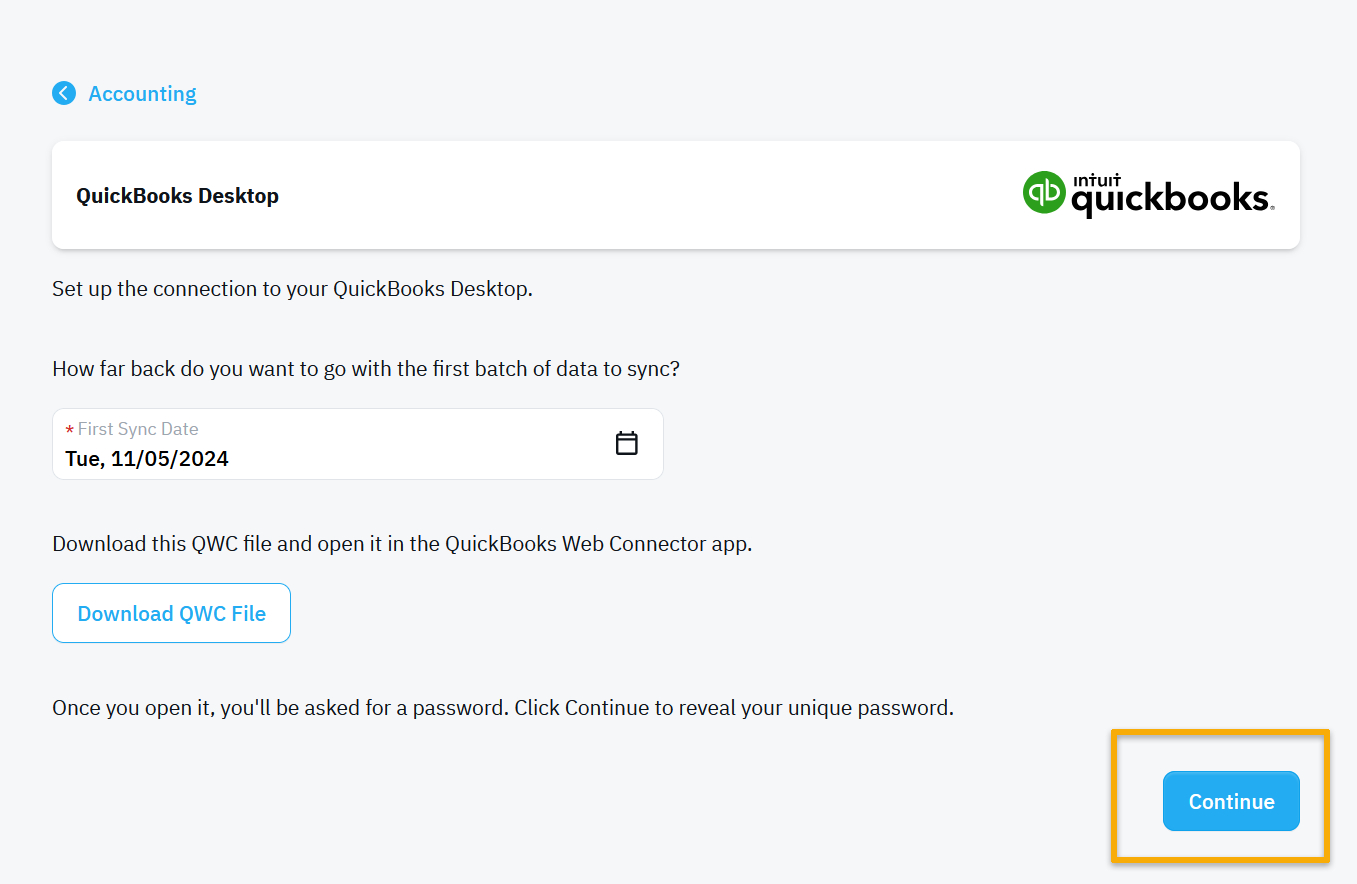

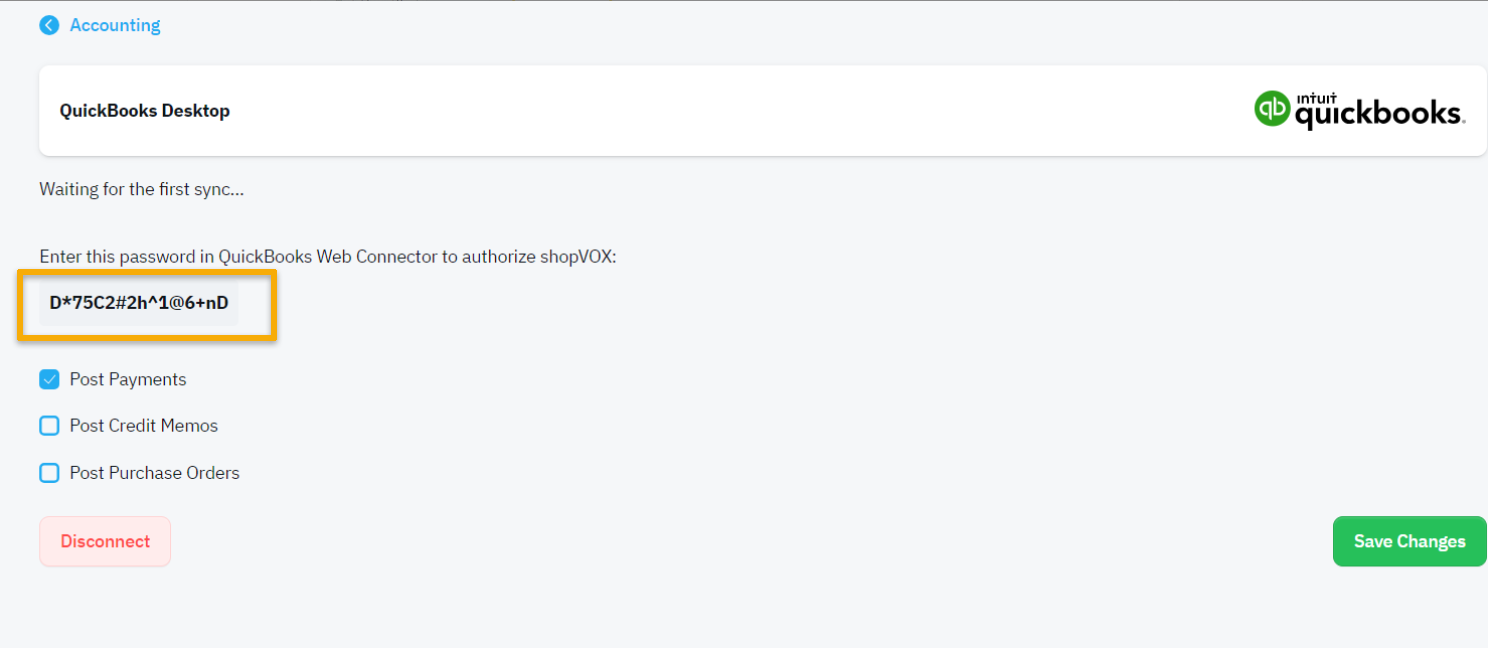

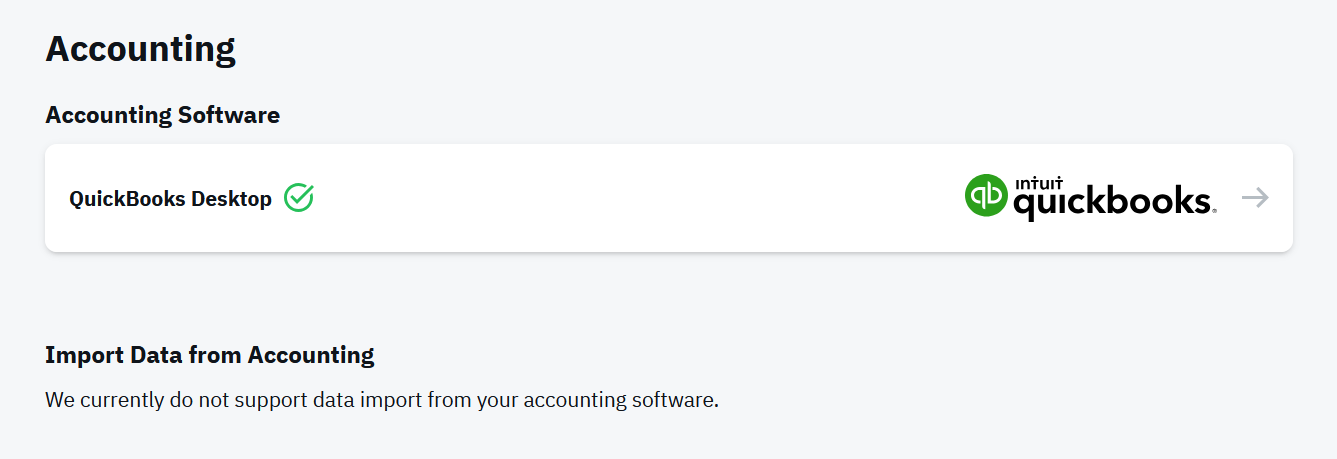

Step 2: Configure shopVOX for QuickBooks Desktop In shopVOX, navigate to Settings > Accounting > QuickBooks Desktop. Confirm the recent sync date

- Confirm the recent sync date

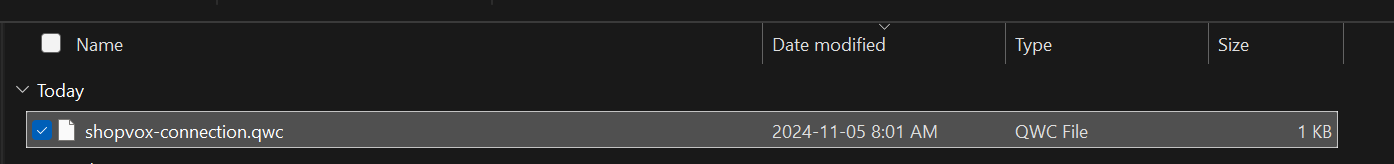

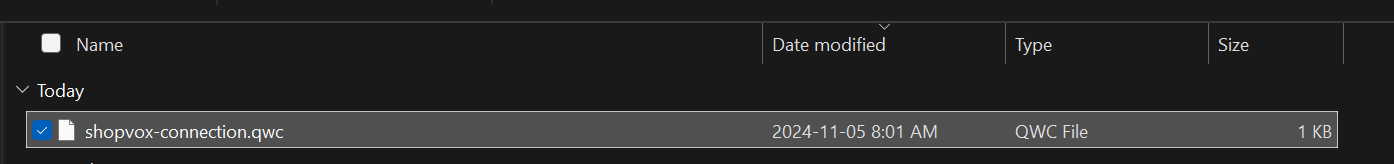

- Download the QWC file, which contains your connection details.

- Open this file to generate a unique password for the QuickBooks Web Connector.

- Click continue in shopVOX to reveal your password

Step 3: Link shopVOX and QuickBooks Within the QuickBooks Web Connector, go to File > Add Application

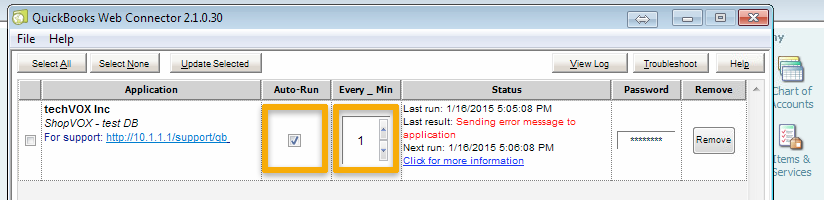

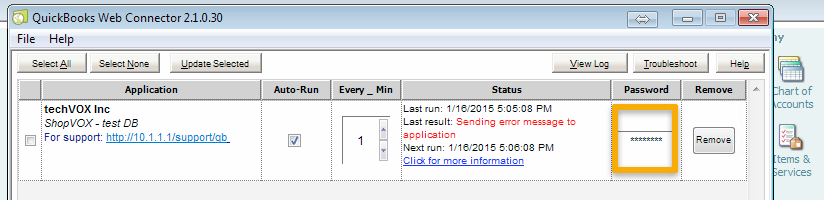

and locate the QWC file you downloaded. Accept the application and set a sync interval (1-5 minutes).

In the password field enter the password previously revealed in shopVOX.

Step 4: Finalize QuickBooks Configuration To ensure smooth syncing, verify these QuickBooks settings:

- Sales Tax: Enable sales tax by confirming "Do you charge sales tax?" is set to Yes.

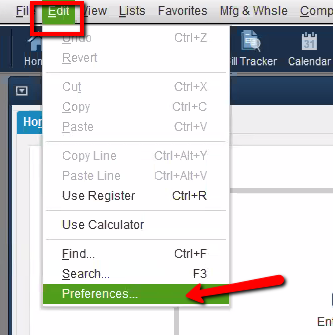

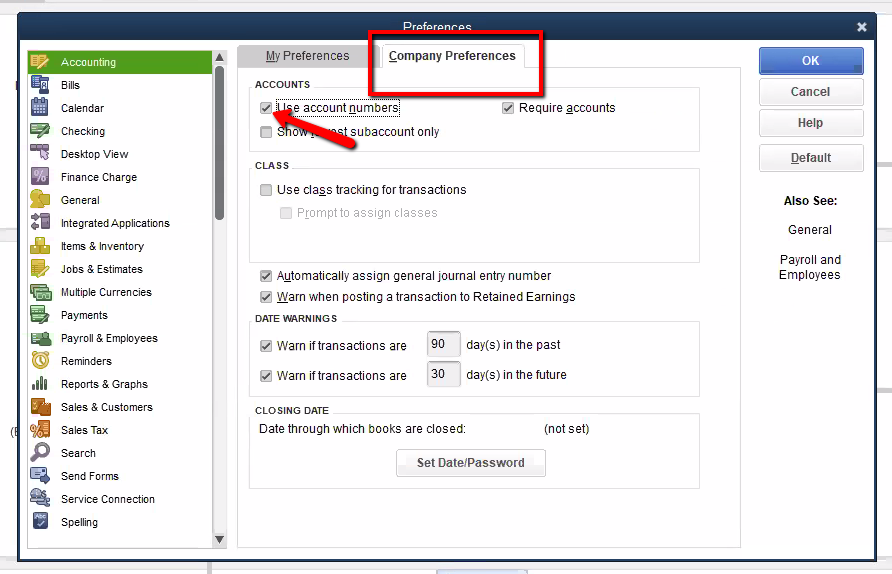

- Accounting: In Edit > Preferences >

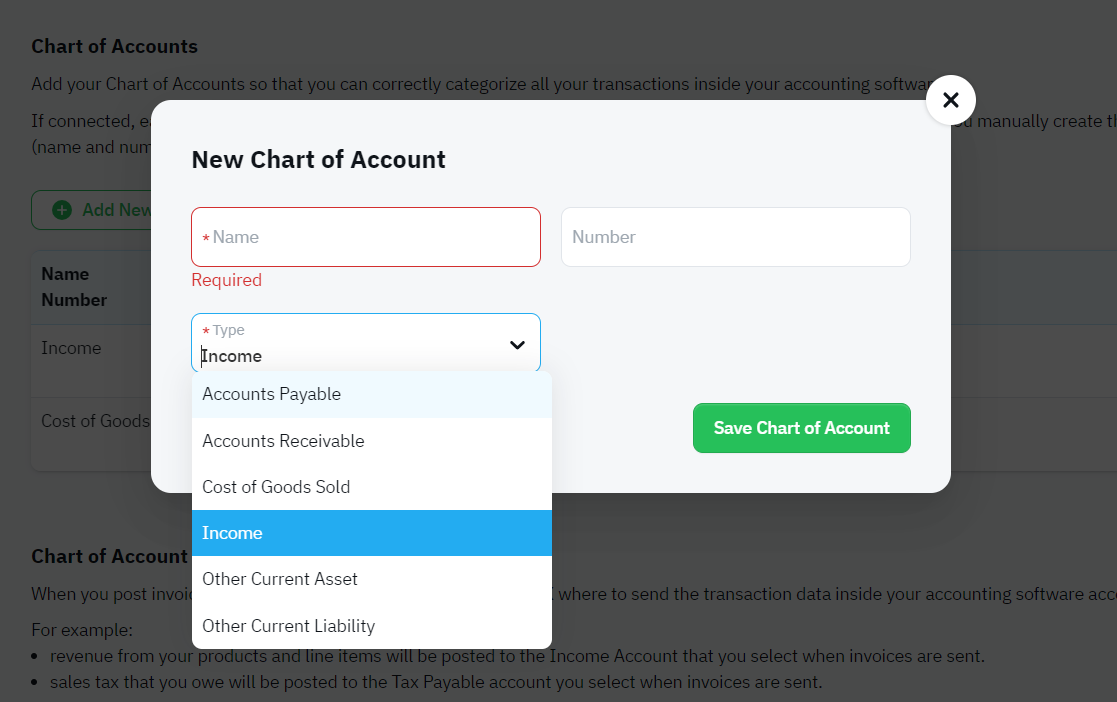

Adding QuickBooks Desktop items into shopVOX

Currently, QuickBooks Desktop doesn’t support direct imports into shopVOX, so you’ll need to manually enter your information.

To align the systems effectively, replicate the following QuickBooks items in shopVOX, using exact names (copy/paste) to ensure consistency and accuracy.

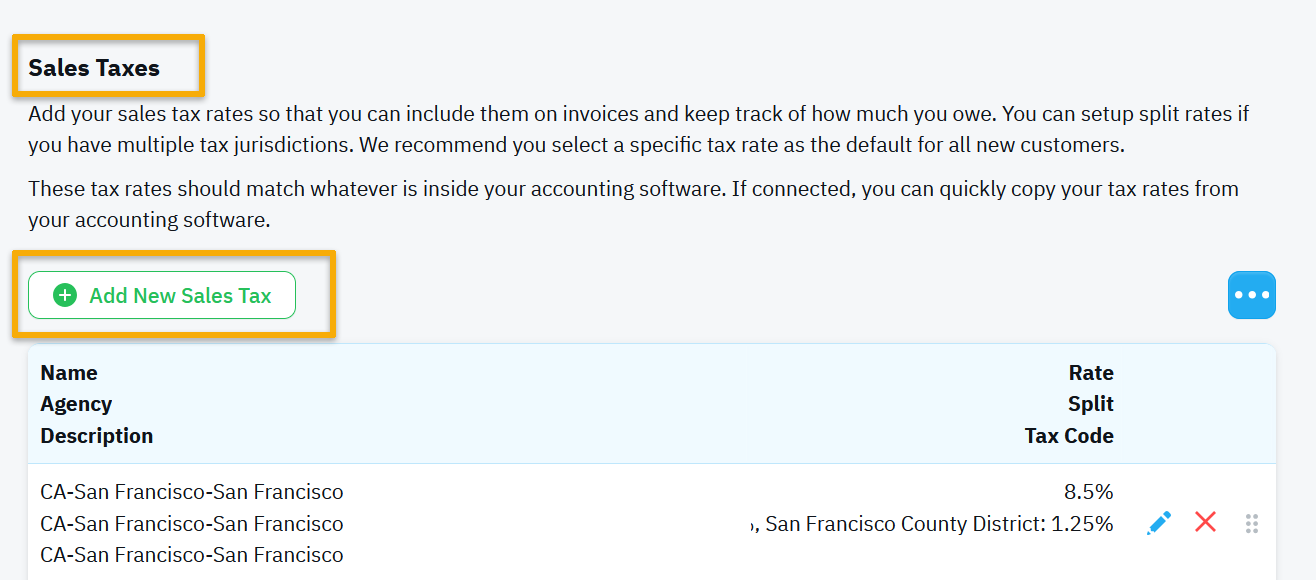

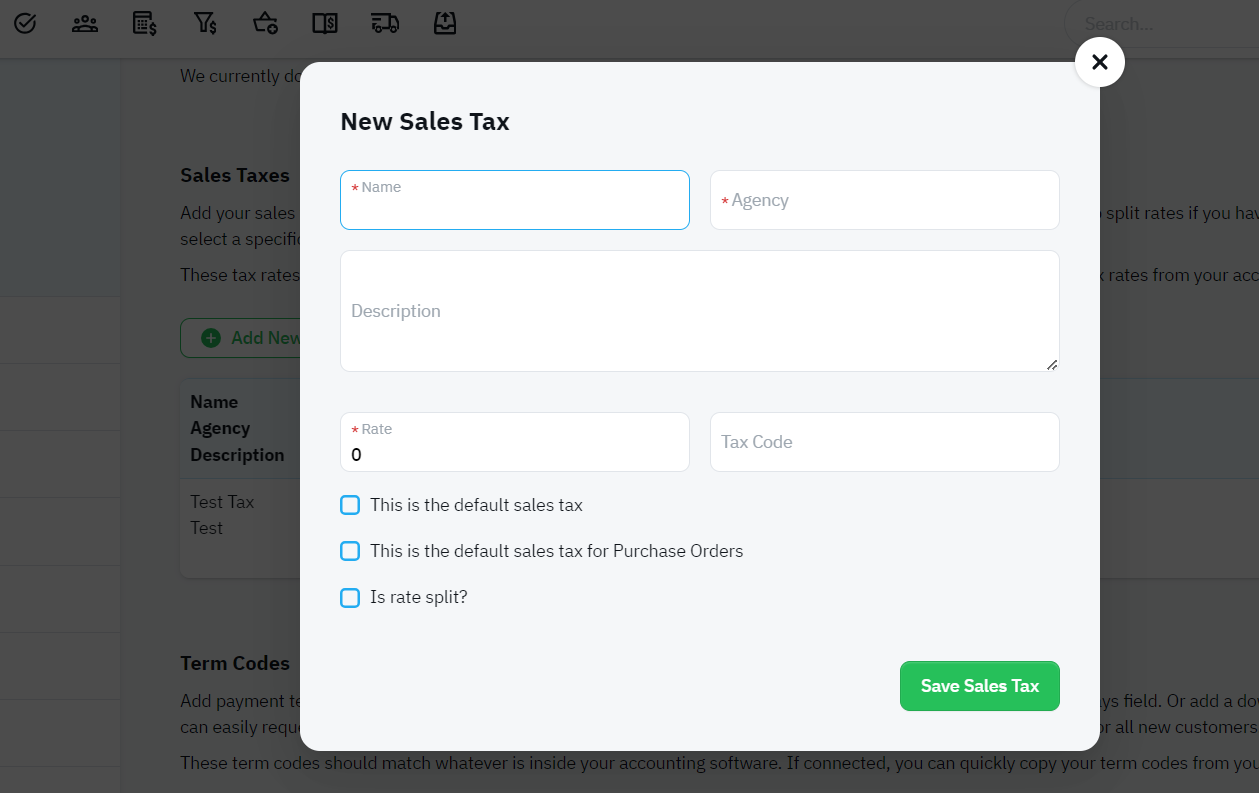

- Sales Taxes – Enter name, agency, rate, and tax code, noting split rates if applicable.

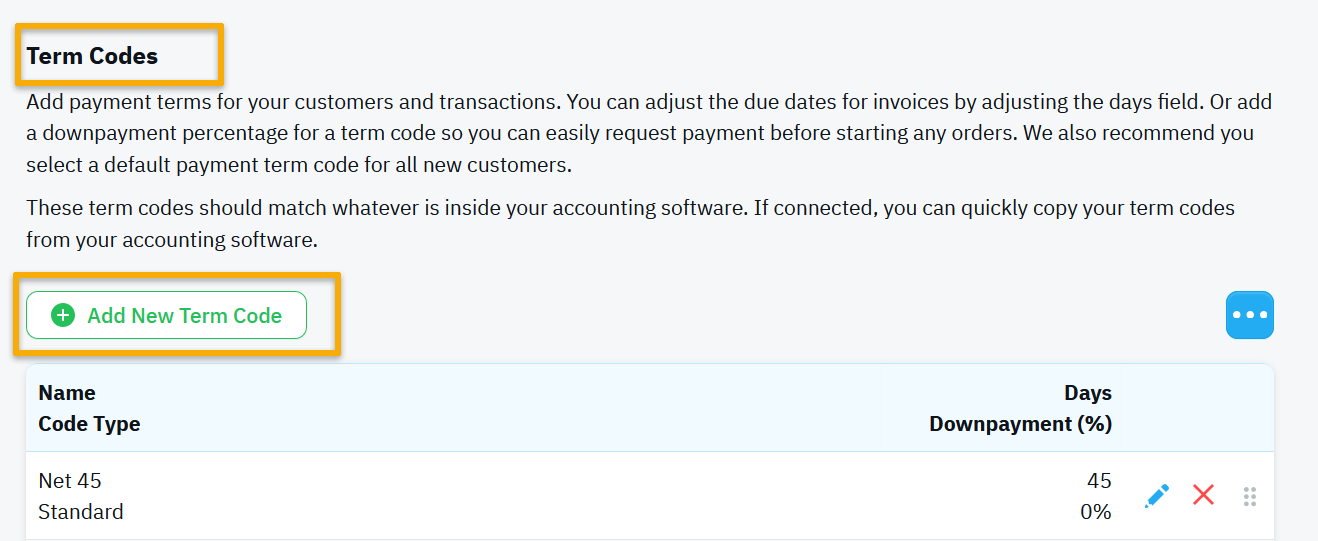

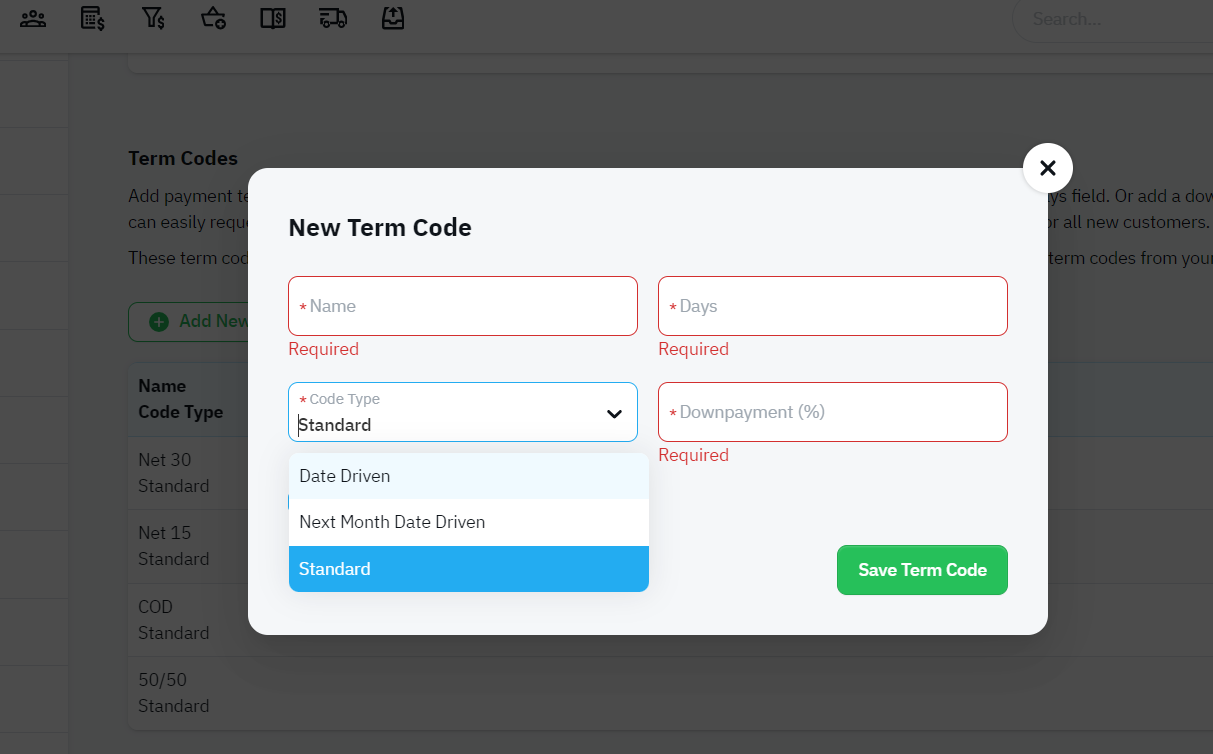

- Term Codes – Include name, number of days, code type, and down payment percentage.

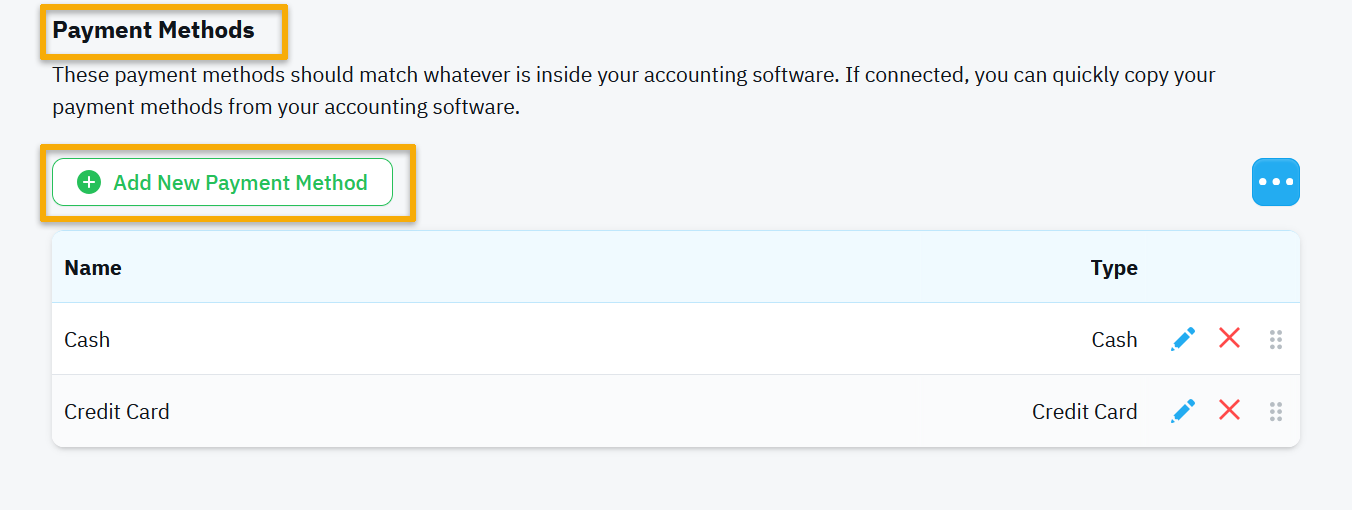

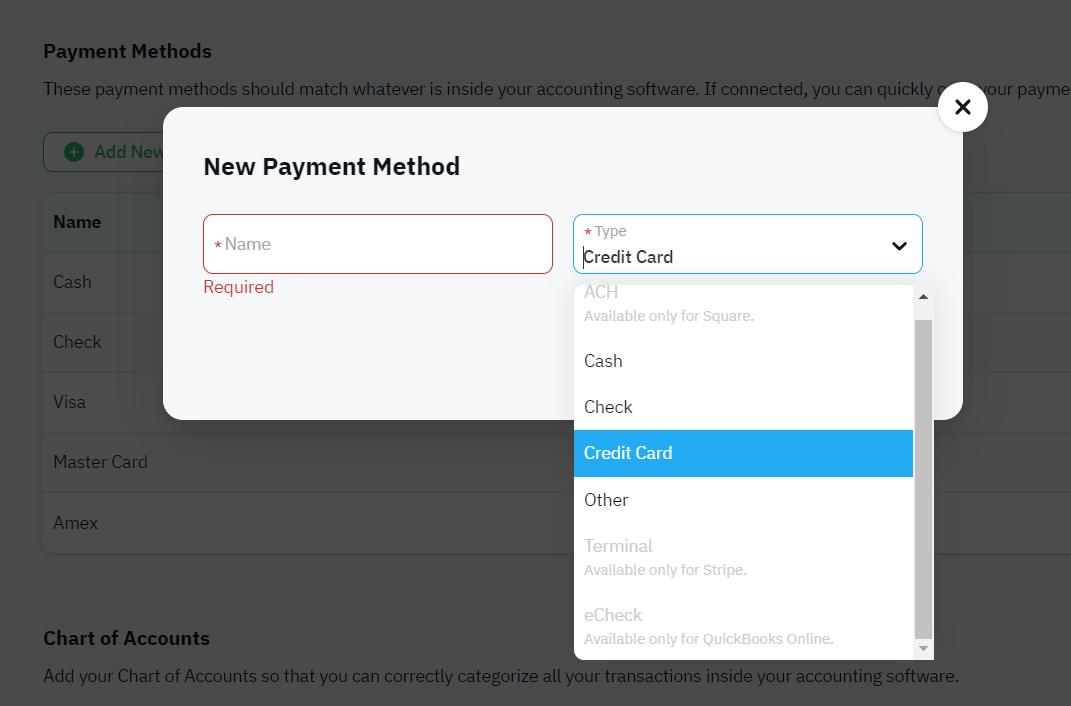

- Payment Methods – Specify name and type. (Some types may vary by accounting software.)

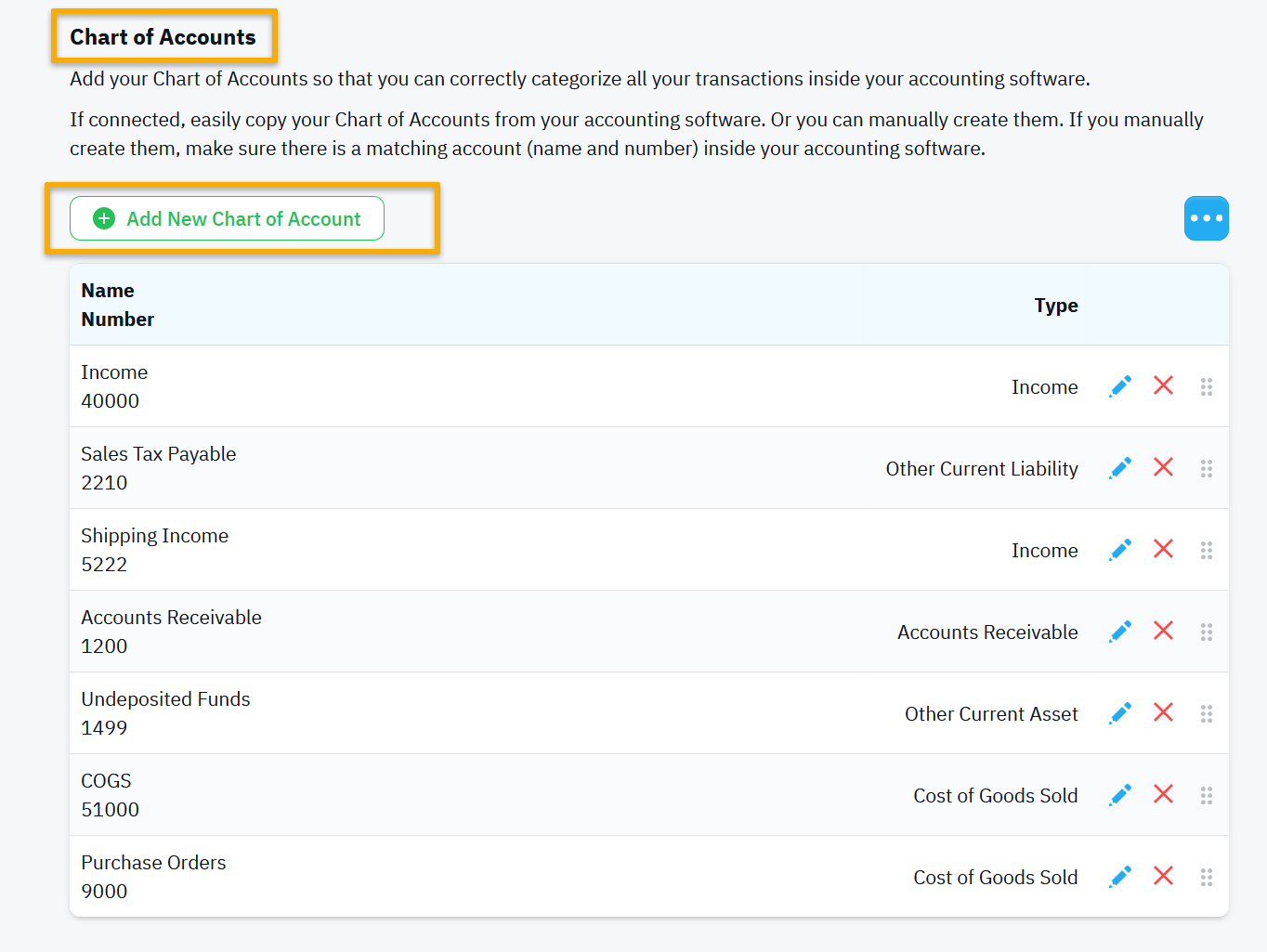

- Chart of Accounts (COA) – You don’t need every COA item—only specific accounts necessary for syncing.

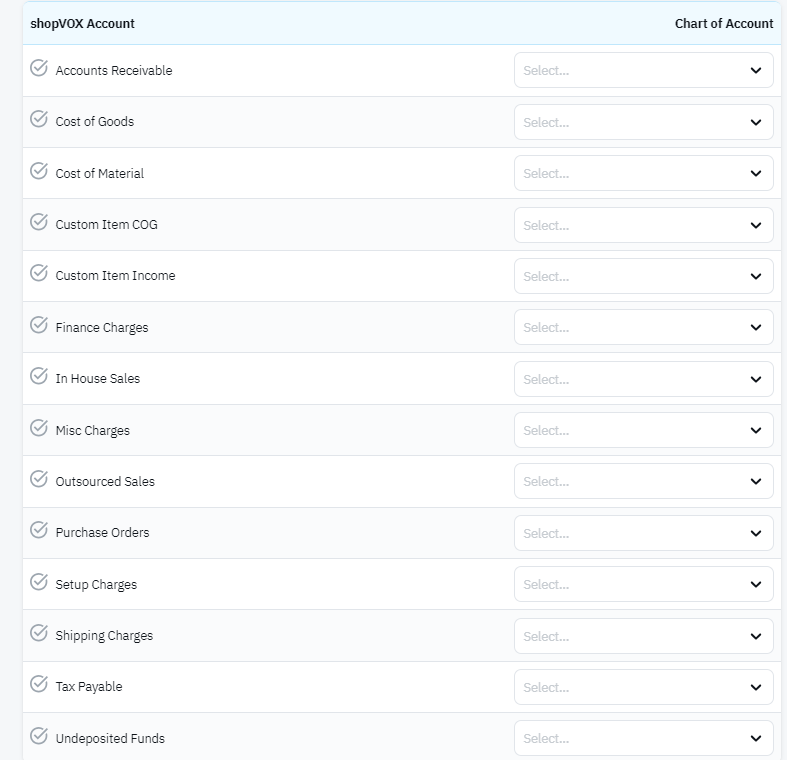

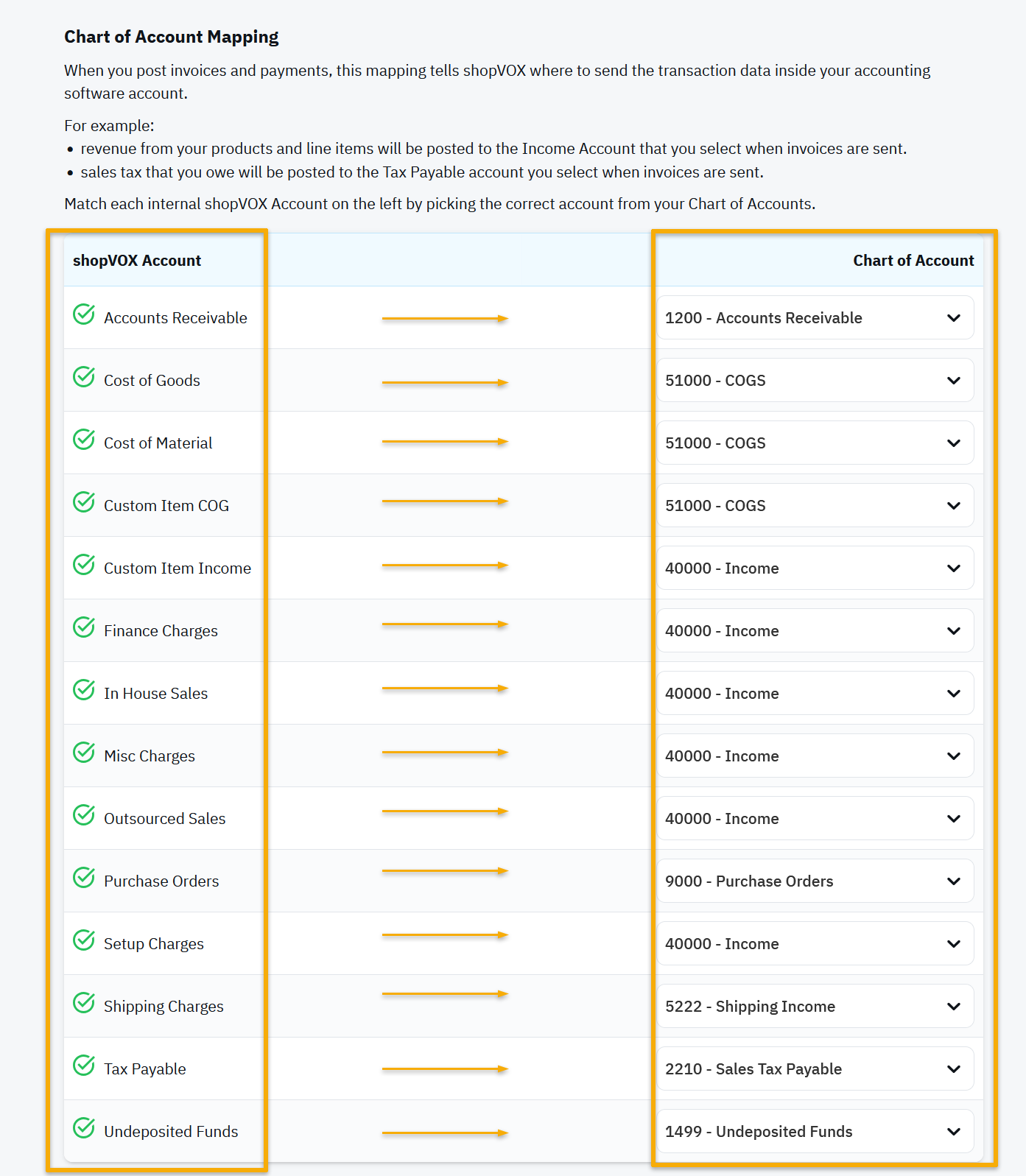

COA Mapping in shopVOX

After setting up COA items in shopVOX, map each to its corresponding QuickBooks account for proper transaction categorization.

Even if you’re not using Purchase Orders, select a QuickBooks account for each type of transaction to ensure compatibility.

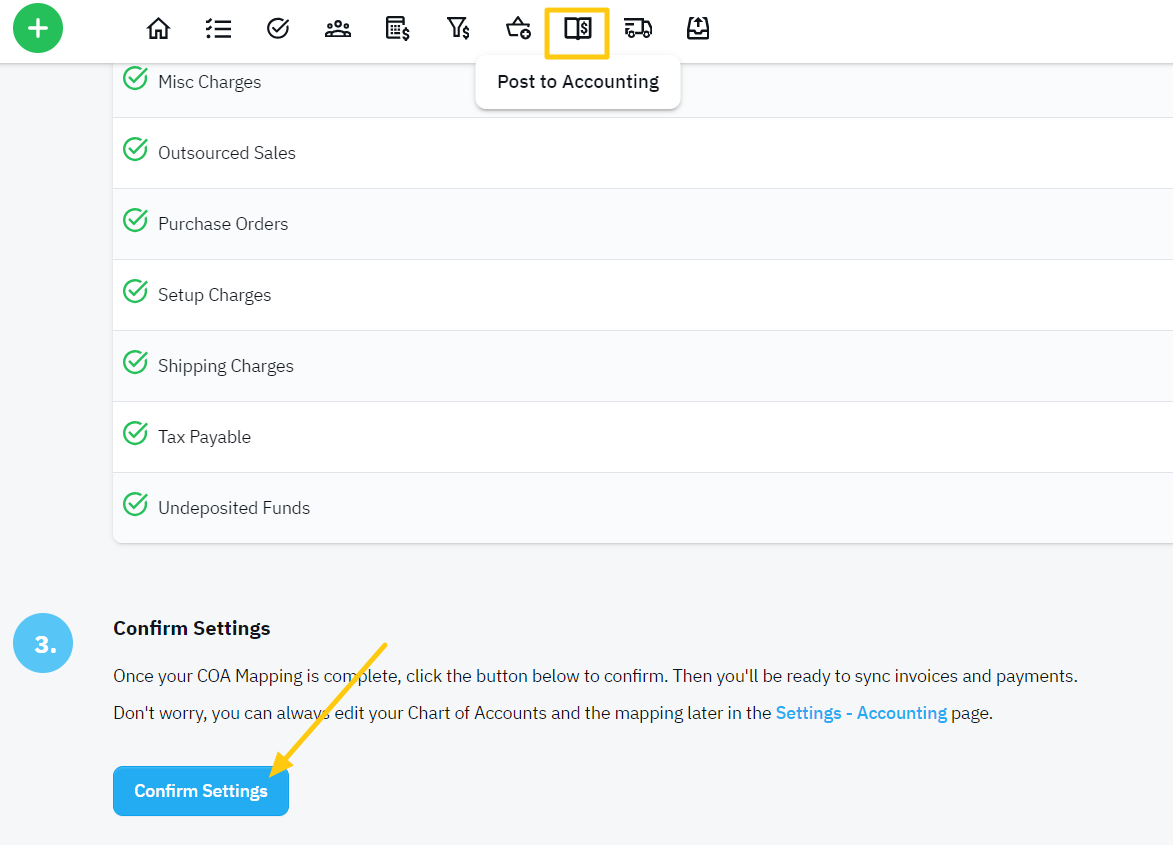

Confirming the Setup

Once everything is configured:

- Click on Post to Accounting within shopVOX.

- Scroll to Step 3 and confirm your sync settings.

Need Assistance?

For questions or additional help, reach out to our Live Support Team or email support@shopvox.com. We’re here to ensure you get the most out of your QuickBooks Desktop integration.

With your QuickBooks Desktop now synced to shopVOX, managing your financials is simpler and more efficient. This integration provides a consolidated view of key financial metrics across both systems, keeping your data accurate and your workflow streamlined. Happy syncing!